Risks permeate all levels of business activities and, if not managed properly, can result in financial losses, deterioration of the organization’s image and reputation and even trigger a crisis.

Risk management has become a matter of utmost importance in the business environment, since awareness of the need to manage potential risks is now a matter of competitiveness and survival.

Risk management is an essential challenge to maintain and add value to a business. As risks have diversified and increased, they will be accepted as opportunities for creating a strengthened management system, aiming at the growth and prosperity of the organization.

It is important to emphasize that, regardless of the size of your organization, whether it is a small business, a medium-sized company, or a large organization, in all scenarios it will be relevant for your success to adopt Corporate Risk Management, to identify in advance the internal and external events that may impact your business plan.

From the moment you decide to identify your company’s risks and take measures to mitigate or eliminate risk, you increase the protection of your business and its perpetuity over time.

How to implement an efficient Risk Management Program? What are the advantages and benefits?

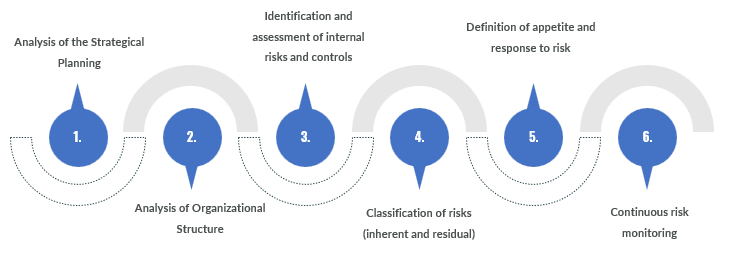

The following steps are essential for implementing an efficient Risk Management Program:

In addition to the above steps, it is crucial to communicate the importance of Risk Management to all levels of the organization. Raising awareness among employees and management about the risks and their role in management is essential to the success of the program.

The implementation of an adequate Risk Management Program should not be seen as an additional cost or bureaucracy, but rather as an opportunity to protect your business. Below we list some of the main benefits and opportunities of efficient Risk Management:

- Reducing financial losses: by identifying and managing risks effectively, the organization can avoid or minimize financial losses resulting from adverse events.

- Cost reduction: A well-structured risk management program can help identify areas of waste and inefficiency, enabling the reduction of operational costs.

- Competitive advantage and innovation opportunities: by identifying risks and opportunities, the company can find new ways to innovate and stand out in the market, creating a competitive advantage.

- Protecting the company’s value: by managing risks, the organization protects its value and assets, ensuring its sustainability and long-term growth.

- Facilitator in decision-making: risk identification allows the company to identify and understand the risks that may affect its objectives and goals, facilitating decision-making.

- Improved operational efficiency: Risk Management helps the company identify inefficient processes and implement measures to mitigate these risks, which can result in greater operational efficiency and financial gain.

- Protecting the company’s reputation: by anticipating and managing risks, the company can avoid situations that could negatively affect its reputation and image in the market.

- Compliance with legal and regulatory requirements: Risk Management helps the company to comply with current laws and regulations, avoiding possible penalties and fines, since these are managed.

Risk management is no longer an option, but a necessity to ensure business sustainability and success. By implementing an efficient Risk Management Program, your company will be better prepared to face future challenges and achieve its strategic objectives.

How can we help?

PP&C has experienced consultants and auditors who understand the dynamics of business, financial and operational processes in various sectors of activity.

Want to know more about our methodology and our introduction to Risk Management Project? Talk to one of our specialists and we will help you overcome this challenge.

Contacts:

Marcos Rodrigues (Internal Audit, Risks and Compliance Partner)

ma.rodrigues@ppc.com.br

Telephone: (11) 98280-5101

Aline Poiani (Internal Audit, Risks and Compliance Partner)

a.poiani@ppc.com.br

Telephone: +55 (11) 97289-8644