Protect your business: the importance of Risk Management.

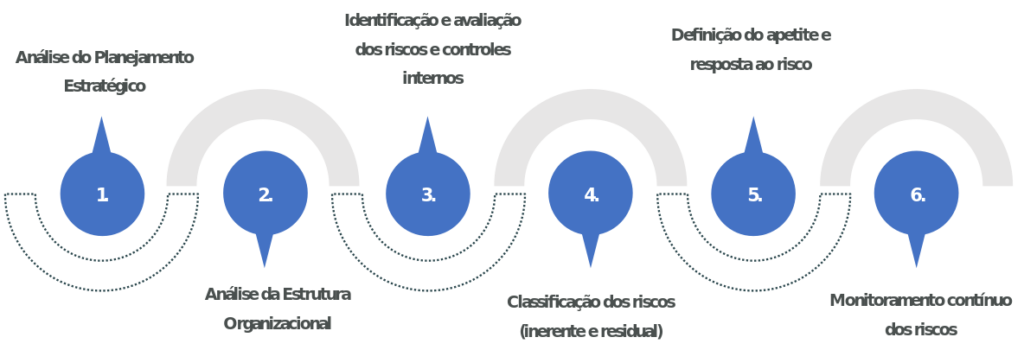

Risks permeate all levels of business activities and, if not managed properly, can result in financial losses, deterioration of the organization’s image and reputation and even trigger a crisis. Risk management has become a matter of utmost importance in the business environment, since awareness of the need to manage potential risks is now a matter […]

Internal audit as a differential in the business transparency process

Risks permeate all levels of business activities and, if not managed properly, can result in financial losses, deterioration of the organization’s image and reputation and even trigger a crisis. Risk management has become a matter of utmost importance in the business environment, since awareness of the need to manage potential risks is now a matter […]

Background check – what is it?

Background check – what is it? A Background check is an assessment of risks presented by third parties, based on relevant, reliable information and, preferably, conducted independently, based on as much information as possible. It is essential that the company carries out this assessment before starting any relationship with third parties, in order to identify […]

The sad reality of digital transformation in the business environment

The sad reality of digital transformation in the business environment Much is said about digital transformation. The use of technology is increasingly present. It is impossible for a company to operate sustainably without the proper use of integrated systems. But, unfortunately, no matter the size – small, medium or large – what is identified in […]

The impacts of the Provisional Measure 1,171/2023 – Taxation of earnings accrued abroad

The impacts of the Provisional Measure 1,171/2023 – Taxation of earnings accrued abroad. This April 30, the Federal Government edited the Provisional Measure 1,171/2023, which brought many changes to the tax regime of financial investments earnings, investments in controlled companies, and trusts abroad held by individuals. Generally, this change will have a relevant impact for […]

New Brazilian transfer pricing rules – material change

New Brazilian transfer pricing rules – material change On December 29, 2022, to the surprise of many, Provisional Measure n. 1,152 was published, which amends the legislation on Corporate Income Tax – IRPJ and Social Contribution on Net Profits – CSLL, to provide for transfer pricing rules. Initially, it should be noted that under the […]

Milestone UK/Brazil Double Taxation Agreement

The United Kingdom and Brazil signed a Double Taxation Agreement (DTA) this week. The Agreement will provide relief from the double taxation of income in both countries and is the most significant development in the trade relationship between the United Kingdom and Brazil in many years and represents a concrete response to demands from business […]

AN OVERVIEW OF THE CURRENT MOMENT OF BRAZILIAN TRANSFER PRICE

Observing the world trend, the Brazilian government incorporated into the tax law specific rules to regulate the prices negotiated in international transactions between companies of the same corporate group[1]. To this end, the Brazilian Congress approved law 9.430/96 which contains specific provisions namely for dealing with Transfer Price. This law completed Brazil’s transition to the […]

Federal Revenue Service vetoes taxpayers from compensating credit on the payment of monthly estimates of IRPJ and CSLL.

This May 30, the Brazilian Government made use of the compliance with the claims of truckdrivers on strike to change the compensation rules of federal taxes managed by the Federal Revenue Service. On that day Law 13,670/2018 was published, which changes Law 9,430/96, among other. According to those changes, which took effect on the date […]

Brazil and Switzerland sign agreement to avoid double taxation

Taxation The agreement aims to encourage mutual productive investment flows, strengthen bilateral commercial relations and contend tax planning This Thursday (3), the Brazilian Federal Revenue Service secretary, tax auditor Jorge Rachid, and the Switzerland ambassador in Brazil, Andrea Semadeni, signed a Pact to Elimitate Double Taxation Related to Levies on Income and Prevent Tax Evasion […]